Easy Intraday Trading with Quick Account Opening

Account Opening

No opening charges for Demat & Trading account.Intraday Trading

Per executed order or 0.03% turnover, whichever is lower.

What is Intraday Trading?

Intraday trading is when shares are bought and sold on the same trading day. As an example you buy 100 shares at 10 a.m. IST and sell the same number of shares before the market closes, which for the Indian Stock market is before 3:30 p.m. IST. The strategies that intraday traders use need to be well thought out and based on research. Day trading also known as short-term investmenting is a type of short-term investment.

For intraday trading, you need a broker where you can get several indicators and charts. To start intraday trading, you can trust Share India. With Share India, you have several indicators and charts. You also get valuable insights and tips related to the share market. In short, you can choose Share India if you want a broker who can deliver you speed, liquidity, and technology.

Intraday trading is a complex trade. But due to technological advances, more traders are engaging and enhancing their financial portfolios daily. Before you conclude, it’s better to understand the concept of intraday trading and how to do intraday trading. There are several strategies & intraday tips that you can integrate with your trade.

There are some valuable tools for intraday, such as stop-loss. A stop-loss tool can be used in a day trade to avoid unwanted losses. A day trader often uses multiple tools and indicators to make a good trading strategy. Traders can use the Share India platform to trade the intraday market.

How Intraday Trading Works?

Now you know what intraday trading is. Hence, you first need to become eligible for intraday trade. You need to open a Demat account and Trading account with Share India. After opening both Trading & Demat accounts, you need to know that intraday trading occurs during market hours, from 9:30 am IST to 3:30 pm.

For intraday trade, start by choosing certain intraday stocks which have a volatile price trend. To place a buy order, you must first define your order as intraday while purchasing any shares.

Suppose you bought 100 shares of XYZ company. After that, you can have a target price at which you want to sell your intraday order.

If the securities reach the target price, you can place a sell order, square off your position and make a profit, and in the opposite scenario, the trader will face a loss in your intraday trade.

Whatever the scenario is, you need to square off your trade before 3:20 pm IST, or else your intraday order will be converted into a Delivery order, and the following shares will be credited to your Demat account.

How to Start Intraday Trading with Share India?

Step 1

Register

Go to the Share India site, Click on Open Demat account, and then enter your email & phone number.

Step 2

Verify

After entering your details, complete the KYC verification

Step 3

Upload

Scan & upload your Aadhaar Card & PAN Card.

Step 4

E-sign & Confirmation

E-Sign Aadhaar through OTP and add nominee details.

Explore the Simple Brokerage Charges

We help you to get value for money financial service. With Share India, you can invest at low brokerage charges.

₹0 On Equity Delivery

No Hidden charges

₹0 Account Opening

No opening charges for Demat & Trading account.

₹20 For F&O

Trade without any worries

₹20 Intraday Trading

Per executed order or 0.03% turnover, whichever is lower.

₹0 AMC

Free maintenance for 365 days of account activation.

Why Choose Share India for Intraday Trading?

One-stop Trading

Share India is the all-in-one professional trading platform. You can explore a range of financial products and services.

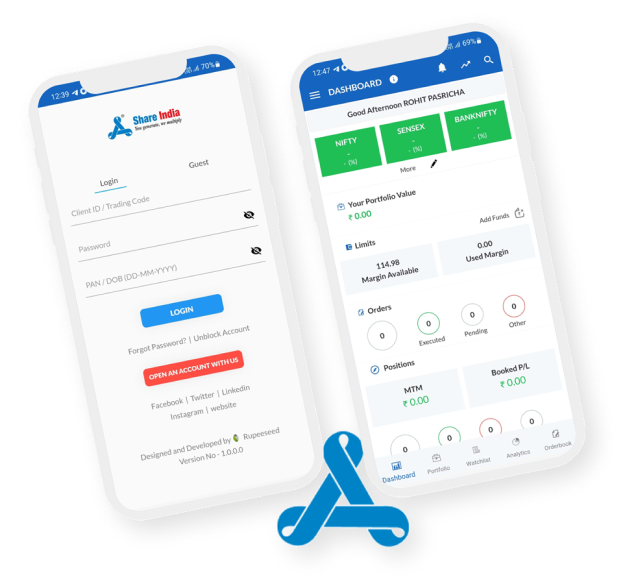

Multiple Devices

Carry your trade anywhere. Share India presents you with web and app-based trading solutions.

Robust & Secure Trading

Every investment is crucial to us. We have built a platform that comes with encryption & essential security features.

Solid Research

You won’t just get research. You will get in-depth research backed by data and studied by industry professionals.

Education

Learning never stops. With Share India, understand & explore the depth of the share market.

Customer Support

Our support works each day to assist all your trading needs. We aim to make trading easy and affordable.

Experience Our Exclusive Products & Services

We are a 28 years young group trying to modify the investing habits of young millennials in India attracted to investing. Share India wants to grow with you by helping you reach your financial and trading goals.

With the help of our technology-driven approach, our unique business model is based on quality and the ability to grow.

Trade confidently with a digital-first approach and insights to make the most of equity markets.

Online Trading Tools & Platforms

Start your trading and investing journey with just a few clicks

Share India offers a robust platform with a hassle-free trading experience. Our goal is to be a company that is of the traders, by the traders, for the traders.

Credibility

Offers trusted and transparent software.

Smart interface

The trading platform is a one-stop trading solution.

Specialised offering

Share India aims to provide the first of its kind algorithmic trading product to every Indian household.

Articles on Intraday Trading

17 Jan / 23

17 Jan / 23Intraday Vs Positional Trading: Know the Difference

Thousands of individuals trade and invest in stocks every day on many of the popular trading platforms. They either engage in day trading or invest in certain stocks for long-term gains.

17 Jan / 23

17 Jan / 23Pros and Cons of Intraday Trading

A trader who engages in intraday trading does the buying and selling procedures on the same day. Intraday traders are typically used by those who want to get their hands in the markets

17 Jan / 23

17 Jan / 23Best Criteria for Choosing Intraday Stocks

Today’s stock markets have a trend known as intraday trading. When newcomers learn about it for the first time, they envision themselves making enormous profits in only a day.

Advantages of Intraday Trading

Intraday trading offers several advantages some of them are as follows:

Timeframe

As you already know that intraday trading is a short-term trading. The time frame for an intraday trade can be 1-minute, 3-minute or 5- minutes chart. Depending upon your trade the timeframe can vary but it couldn’t go further till the end of the trading session. As per your calculation and trade, you can make better returns & invest in the stock market.

Leverage

You can easily get 2X to 4X leverage for your intraday trade. Doing intraday trade with leverage can be more risky. Before taking leverage, it’s advised to know the terms & conditions of the broker. With more capital you can also increase your profit, if your intraday trading strategies works well. Learning different intraday trading strategies can help you execute your trade successfully.

Less Risk

Compared to other types of trading, Intraday trading has no overnight risk. Traders can do trade without worrying about the next day’s events, news or any changes in the finance world. Intraday traders often plan to make profit in small price differences which can easily be achieved if the stock is volatile & has high liquidity.

Stop-loss order

In your intraday trade, the price can be highly volatile, and chances of closing your position before getting huge losses is high. To cut down the risk, a trader often uses a stop-loss order which can execute your trade as soon as it reaches a predetermined price set by the trader. Time frame & the trade on price difference with higher capital is the key for doing day trading. Due to this it’s important to set a stop-loss order to cut-down higher risk on your trade.

What our Customers are Saying