Open Trading Account Online

Benefits of Opening an Online Trading Account with Share India

Flexibility

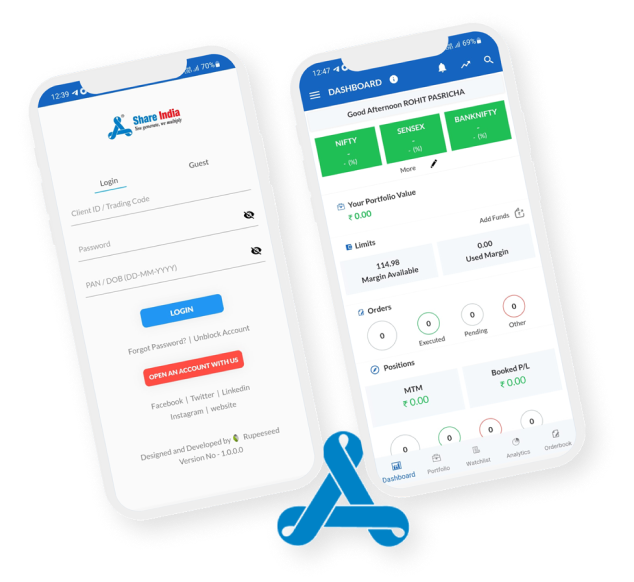

When you open a share trading account with Share India, you get the full flexibility of tracking your investment. You can track your investment through your smartphone or your desktop.

Competitive Pricing

Unlike the old days when a trader needed to pay hefty stamp duty, Now the same trader needs to worry about high brokerage charges. Share India offers zero or low charges for all your executed trades.

Frequent Update

An online trading account lets a user track its portfolio where it shows your Profit or loss of certain security. With a Share India trading account, you can manage all your trading activity from your smartphone.

Endless Transaction

Instant and accurate trading transaction. With advanced technology & enormous speed, you can buy or sell shares in just a few seconds. You can buy or sell shares in any quantity online.

4 Steps to Open Trading Account

Step 1

Register

Go to the Share India site, Click on Open Demat account, and then enter your email & phone number.

Step 2

Verify

After entering your details, complete the KYC verification

Step 3

Upload

Scan & upload your Aadhaar Card & PAN Card.

Step 4

Open an Online Trading Account

E-Sign Aadhaar through OTP and add nominee details.

Documents Required to Open a Trading Account

You need to submit the digital copy for the following document in order to open a share trading account with Share India. Trade in a hassle-free way through Share India platform.

PAN Card & Aadhar Card

Submit your PAN card and Aadhar card scanned copy, issued by the Government of India. Make sure that the signature and photo must be visible in the PAN card.

E-Signature

You need to e-sign on white paper and upload on the ekyc.shareindia.com. Remember that your signature must match the PAN card signature.

Bank Account

Link your bank account to your trading account with penny drop facility.

Begin your Trading Journey with an Experienced Brokerage Company

Start your first step with expert guidance. Join the Share India family to get the technology & expertise you deserve. Learn.Trade.Earn and Repeat.

Quick Trading

Quick Trading

Paperless Trading account opening

Onboard from the Share India website or online trading app

Start your trading with an experienced broker

Multiple Opportunities

Multiple Opportunities

Invest in multiple assets

Easy access to all assets

Track each investment

Informative Updates

Informative Updates

Get regular insights

Live market update

Learn trading online from articles & videos

Get instant access to Investment Opportunities

Stock Trading

Stock trading is a smart & fastest way of investing. There are a lot of opportunities in the Stock Market. All you need to do is perform qualitative research on a particular stock and invest accordingly.

- Share India provides quality research & reports on the stock.

- Get quick access to the stock market online.

- Manage & track all your financial assets.

IPOs

Invest in your choice of IPO. Learn about the financial aspect of a company. Grab the opportunity to invest in the latest IPO. Check more information about IPOs

- Add IPO to your financial portfolio

- Track and bid on your choice of IPO

- Frequent updates about the latest & upcoming IPOs

Intraday Trading

Perform intraday trading with better research & strategies. Share India provides multiple trade strategies for active traders.

- Live update about shares.

- Get research from experts.

- Trade with insights & research.

Trade in F&O

Hedge your investment with F&O trading. Learn to trade in the Future and Options market. Explore new investment opportunities with Share India

- Plan your trade with experts

- Get research from experts.

- Trade with insights & research.

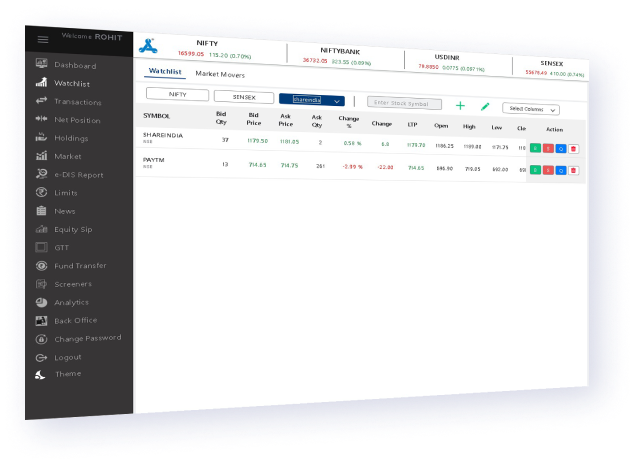

Online Trading Tools & Platforms

Start your trading and investing journey with just a few clicks

Share India offers a robust platform with a hassle-free trading experience. Our goal is to be a company that is of the traders, by the traders, for the traders.

Credibility

Offers trusted and transparent software.

Smart interface

The trading platform is a one-stop trading solution.

Specialised offering

Share India aims to provide the first of its kind algorithmic trading product to every Indian household.

What is a Share Trading Account?

Trading in the stock market is used as a link between your Demat account and the market. Online share trading account opening with Share India opens a bridge between you and market opportunities. A trading account provides a user with better exposure to the profit/loss of their investments.

Each trading account has its unique ID, which a stock broker manages. If you want to sell your holding into the equity market, you need to place a sell order for, say, ten shares of an xyz company. This order will go into the stock exchange via your broker app and then get executed. To open a share trading account in 10 minutes, join Share India & trade at lightning speed.

Trading in the stock market can be intimidating and risky, but it can also be a great way to make money if done correctly. Knowing what a trading account is and how to use one properly is key to having success in the stock market.

With a share market account opening with Share India, you get a platform to monitor investments and provide real-time updates on the changing prices of stocks. Practical knowledge plays an important lesson to provide insight into the stock market and aid in making informed decisions when investing.

Things to Look for Before Opening an Online Trading Account

Multiple Tradable Instruments

Determine whether the brokerage offers a diverse range of tradable instruments that align with your trading preferences. Whether you are interested in stocks, bonds, forex, commodities ensure that the brokerage provides access to the markets and instruments through the online trading account you intend to trade.

Charges & Commissions

Analyse the fee structure and commission rates offered by different brokerages. Consider factors such as trading fees, account maintenance charges, inactivity fees, and withdrawal fees while you open a trading account. While low fees are desirable, also weigh the services and features provided against the cost to ensure a good balance.

Reliability

One of the primary factors that should be considered before you open a trading account is the brokerage’s reputation and reliability. Go for brokerages that have a strong track record and are well-established in the industry. Read customer reviews, testimonials and independent ratings to the brokerage’s reputation for customer service, execution speed, and reliability of their trading platform. It’s important to carefully evaluate and compare various brokers to open a trading account online.

Customer Support

Opening a trading account with a broker is essential for those who wish to participate in the stock market. Reliable customer support is essential, especially for new traders or during times of technical difficulties in online trading account. Look for brokerages that offer multiple channels of communication, such as phone, email, and live chat, and assess their responsiveness and helpfulness. Through Share India’s trading platform you can conveniently open a trading account online and start your investment journey with Share India.

What our Customers are Saying