Futures Trading Platform at Share India

Open a *Free Futures account with Share India. Diversify your portfolio with a broker who understands your financial goal. Learn & trade with Share India.

Our Futures Trading Charges

Benefits of Futures Trading with Share India

Quick Trading

Completely Paperless account opening process. Onboard from the Share India App or share trading app. Trade in a hassle-free environment.

Multiple Opportunities

Explore & trade in multiple assets. Manage & all access to all assets under one roof. Track each investment daily.

Informative Updates

Trade with quality insight & news. Get the market update and increase your knowledge of the share market. Learn trade from a professional broker.

Secure Trading

Now trade without any worries. Explore our platform that comes with encryption & essential security features.

What is Futures Trading?

Futures trading is a type of contract-based trading in which two parties, such as a buyer and a seller, make a deal. Both sides can agree on a price at which they will buy and sell the underlying assets. Stocks or other financial securities can be the underlying asset. Futures end on a certain date. Before the futures contract’s end date, both parties need to make their trade. Stock exchanges keep an eye on every contract.

A futures contract is for traders who know what they’re doing. You can use futures to protect your portfolio and take advantage of opportunities. Open an F&O account with Share India to start trading futures. Share India will give you live updates and good insights.

When you trade futures, take note of the expiry date and the contract size. In India, the expiration date for derivative investments like futures is the last Thursday of expiry month. It’s also worth noting in futures trading you can trade futures contracts having a near month expiry, the next month expiry, or far month expiry. In derivative trading, one must also be aware of the contract size or lot size. A single futures lot may contain multiple units of the underlying assets. The number of units per lot depends on the underlying asset.

Since derivative trading in the share market involves trading lots containing multiple units of the underlying assets, unlike the cash market where you can trade individual units of the assets, futures trading has a higher entry barrier. However, that said as a futures trader, you take a future position by paying only a portion of the entire transaction called margin. You pay the remaining amount when you settle the contract during expiry.

If you wish to become a practitioner of derivatives trading in India, it is also essential that you know how futures contracts are settled. In the case of index futures (Nifty or Bank futures), the difference is settled in cash. However, in the case of stock futures, the contract is settled by delivering or accepting the delivery of the stock.

Futures trading can be a great way to create wealth if you understand the derivative trading and trade responsibly.

Checkout Our Futures Trading Charges

We help you to get value for money financial service. With Share India, you can invest with unbeatable trading charges.

₹0 On Equity Delivery

No Hidden charges

₹20 For F&O

Trade without any worries

₹20 Intraday Trading

Per executed order or 0.03% turnover, whichever is lower.

₹0 AMC

Free maintenance for 365 days of account activation.

Steps to Start Futures Trading Now

Step 1

Register

Go to the Share India site, Click on Open Demat account, and then enter your email & phone number.

Step 2

Verify

After entering your details, complete the KYC verification

Step 3

Upload

Scan & upload your Aadhaar Card & PAN Card.

Step 4

E-sign & Confirmation

E-Sign Aadhaar through OTP and add nominee details.

Our Exclusive Product & Services

We are a company that wants to change the way millennials trade. Share India believes in democratizing its trading prowess and make the platform available to all.

Our unique business model is based on quality and scalability, and is driven by technology.

Trade confidently with a digital-first approach and insights to make the most of equity markets.

Why Should You Trade in Futures?

How Futures Trading Works?

Predetermined Price & Expiry

When you trade a futures contract, you are obliged to transact the underlying asset on the fixed date and price.

Deposit the required margin

Trading futures requires you to deposit a margin with the broker, which is a portion of the total transaction amount, regardless of whether you are buying or selling.

Take a long or short position

Take a long position or buy the futures contract if you believe the price of the underlying asset will see an appreciation. Derivatives in the stock market work on the research & decisions of buying and selling contracts, so if you sell the contract you believe the price of the underlying asset will decline.

Settle the contract or close the position before expiry

On the expiry date, you settle the contract by buying or selling the underlying asset, in the case of stock futures, or settling it in cash in the case of index futures. Or, if you are satisfied with your profits, you can close your position before the expiry. Derivatives investment can be risky if you are a beginner or unaware about the risk of derivative trading.

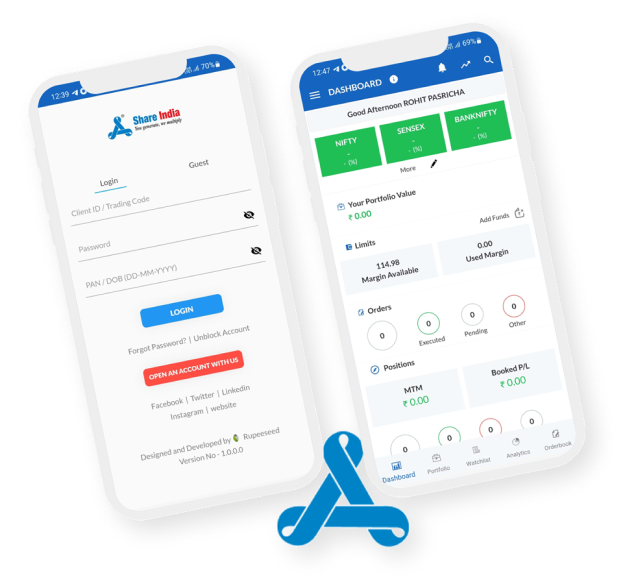

Online Trading Tools & Platforms

Start your trading and investing journey with just a few clicks

Share India offers a robust platform with a hassle-free trading experience. Our goal is to be a company that is of the traders, by the traders, for the traders.

Credibility

Offers trusted and transparent software.

Smart interface

The trading platform is a one-stop trading solution.

Specialised offering

Share India aims to provide the first of its kind algorithmic trading product to every Indian household.

Learn, Apply, Earn, Repeat – Make the Most of Our Latest Blogs

15 Dec / 23

15 Dec / 23Beginner’s Guide to Currency Trading: How to Trade Currency in India

Currency trading, also known as foreign exchange or foreign exchange trading, involves buying and selling currencies from different countries with a view to making a profit. The United States dollar is the most widely traded currency in India, and the other currencies traded are the Euro, Japanese Yen, and British pound.

15 Dec / 23

15 Dec / 23Comprehensive Guide for Mutual Fund Distributors and Agents in India

Good understanding and awareness are required to invest in mutual funds. Nowadays, all information about a fund is available on the Internet, so investors can compare various funds before starting to invest. However, the mutual fund agent plays a significant role when considering all the facts. Agents have a significant role to play in developing the mutual fund industry in India.

15 Dec / 23

15 Dec / 23A Definitive Guide to Becoming a Franchise Broker in India

In India, becoming a franchise broker is more than just a fantasy. When you truly think about it, the process of becoming one is not that tough. Even though there are numerous challenges to conquer, being ready for the journey ahead is all that is necessary. In India, aspirant business owners and franchisors may commonly wonder: what is franchise broker, and how can I become one? What steps should I take to apply for a franchise? Whenever someone tries to realise their lifelong dream of being a franchise broker, these are some of the questions that always cross their minds.

What our Customers are Saying