Have you ever wondered how top traders consistently stay ahead of the curve? The answer often lies in the tools they use. Share India is dedicated to empowering traders with cutting-edge tools and technologies. We continually enhance our features to provide traders with the best possible insights and resources. The 50 market Depth feature is a powerful addition to Share India’s suite of trading tools that offers unparalleled market transparency and insight, significantly enhancing trading strategies and decision-making processes. Let’s explore how this feature can help you achieve better trading outcomes.

What is the 50 market Depth Feature?

- The 50 market Depth feature enhances the trading experience for its users.

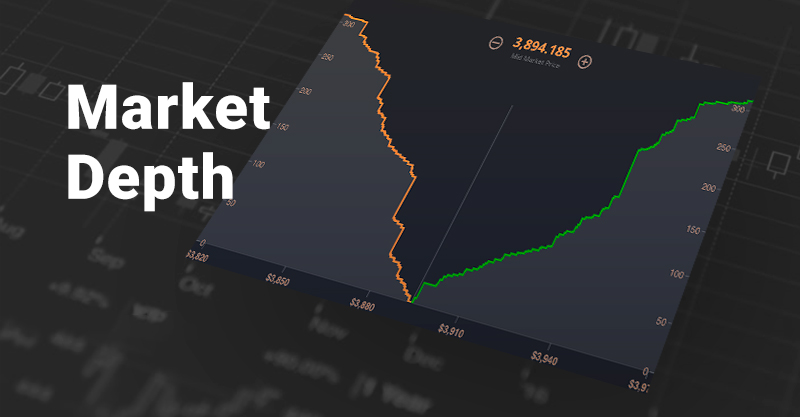

- Unlike the regular market depth, which typically displays only the top 5 or 20 bids and offers for stocks, the 50 market Depth feature on the Share India app offers visibility into the top 50 bids and offers.

- This expanded view provides traders with a deeper understanding of the stock market dynamics and helps them identify potential trading opportunities with greater precision.

- In the standard market depth view, traders can see either the best 5 or the best 20 bids and offers for a stock. While this data only provides a limited view of the market, the 50 market Depth feature does not let you settle for less by providing information on the top 50 bids and offers.

Benefits of Using the 50 market Depth Feature

- Increased Market Transparency: This feature provides a comprehensive view of the stock market, helping traders gauge overall market sentiment more accurately. For instance, a multitude of asks may suggest selling pressure, while a large number of bids can indicate strong buying interest.

- Informed Trading Decisions: Traders can make informed decisions with access to more data points. For example, if a trader sees that the top 50 asks are significantly higher than the current price, then he might decide to hold off on selling. This feature helps in identifying short-term trends and potential reversals.

- Improved Risk Management: Traders can assess potential risks by analysing deeper market levels. For example, large gaps in bids or asks at certain levels might indicate potential volatility. This information can also be used to set more strategic stop-loss.

- Identification of Market Manipulations: The 50 market Depth feature helps traders spot unusual trading patterns that might indicate market manipulation, such as spoofing (placing large orders with the intent to cancel). Traders can also protect their investments and make more reliable trades by identifying and avoiding manipulated markets through this feature.

Practical Application for Traders

- Scalping: Scalpers, who rely on small price movements, benefit from the 50 Depth feature by gaining more granular visibility of the order book. This helps them execute quick trades with higher precision.

- Swing Trading: Swing traders can use the 50 market Depth feature to identify longer-term trends and potential reversal points by observing how orders accumulate or disappear over time. A comprehensive understanding of the market depth also helps in setting more accurate entry and exit points.

- Long-Term Investments: This feature assists in making strategic decisions and gives market confidence to traders. The broader market depths help long-term investors make strategic decisions about entry or exit positions.

Conclusion

The 50 market Depth feature is a highly advantageous tool for traders of all levels. Whether you are a novice trader or an experienced professional, incorporating the 50 market Depth feature into your trading toolkit can lead to more informed decisions and better trading outcomes. It enhances trading strategies across various styles like scalping, swing trading, and long-term investing. This feature provides traders with market confidence and precision for strategy execution, ultimately contributing to more successful trading endeavours.

It provides some other applications for traders like:

Enhanced Trading Strategies: Beyond its immediate benefits, the 50 market Depth feature empowers traders to develop and refine their trading strategies. By providing a detailed view of market dynamics, traders can adapt their approaches to different market conditions, whether they are navigating volatile periods or identifying steady long-term opportunities.

Adaptive Decision-Making: In fast-paced markets, the ability to quickly assess and respond to changing conditions is invaluable. The 50 market Depth feature equips traders with the insights needed to make adaptive decisions, reducing the risk of reactive trading and enhancing overall portfolio management.