In the digital age, the stock market is no longer the exclusive playground of seasoned traders and financial institutions. Online trading apps have democratised access, enabling a broader and more diverse group of individuals to participate in stock market activities. This revolution in stock market participation is driven by several key factors. Let’s explore how these factors are transforming the financial landscape.

Table of Contents

Accessibility and Convenience

One of the most significant ways online share market apps revolutionise stock market participation is by making it accessible to almost anyone with a smartphone and an Internet connection. Gone are the days when potential investors needed to navigate the intimidating halls of brokerage firms or deal with complex trading desks. Now, with just a few taps on a mobile device, anyone can buy and sell stocks, bonds, ETFs, and other securities.

Breaking Geographic Barriers

These eliminate geographic barriers. Investors no longer need to be physically present in financial hubs like New York or London to trade. At Share India, the company focuses on transforming the millennial trading experience through a cutting-edge fintech platform. By leveraging advanced technology and user-friendly interfaces, it enables global accessibility, allowing individuals from all corners of the world to participate in the stock market. This approach fosters a more inclusive financial ecosystem, enabling a diverse range of people to engage in financial markets. Through continuous innovation and adaptation to the needs of modern traders, it aims to create a more connected and equitable financial landscape.

User-Friendly Interfaces

The design and functionality of online share market apps are tailored to be user-friendly, even for those with minimal financial knowledge. Intuitive interfaces, streamlined processes, and easy-to-understand charts and data make it simple for beginners to start trading. Features like voice commands and touch ID add to the convenience, making the experience seamless.

Cost Efficiency

Traditional trading often involved significant costs, including high brokerage fees, commissions, and account maintenance charges. Online market trading apps have drastically reduced these costs, making investing more affordable for the average person.

Zero Commission Trades

Many online trading platforms offer zero-commission trades, which means users can buy and sell stocks without paying a fee per transaction. This shift has made it possible for individuals to trade more frequently and with smaller amounts of money, encouraging more people to engage with the stock market.

Lower Account Minimums

Traditional brokerages often required substantial minimum deposits to open an account. Online trading applications, however, typically have low or no minimum balance requirements, removing a significant barrier to entry for many potential investors.

Educational Resources

Knowledge is power, especially in the stock market. Recognising this, many online market trading apps provide a wealth of educational resources to help users make informed decisions.

In-App Learning

Online trading apps often include tutorials, articles, webinars, and even interactive courses designed to educate users about the stock market, investment strategies, risk management, and more. This democratisation of financial education empowers individuals to take control of their financial future.

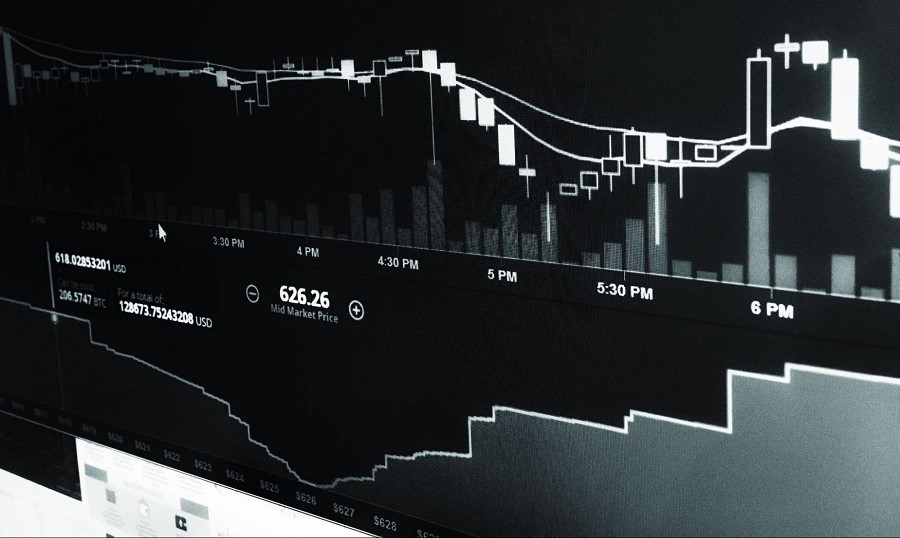

Real-Time Data and Analysis

Access to real-time market data and analysis tools, like on the Share India platform, is another game-changer. Users can track market movements, read expert analyses, and utilise various tools to predict trends and make informed decisions. These resources, which were once the purview of professional traders, are now available to anyone with a smartphone.

Social Trading and Community Features

The integration of social features into online trading applications has fostered a sense of community among investors. These platforms often include social trading features where users can follow and learn from experienced traders, share insights, and discuss strategies.

Copy Trading

One innovative feature is copy trading, which allows users to replicate the trades of successful investors. This not only helps beginners learn by observing the strategies of more experienced traders but also enables them to potentially profit from the expertise of others.

Discussion Forums and Groups

In-app discussion forums and groups provide spaces for users to share tips, ask questions, and discuss market trends. This community aspect helps build a support network for traders, enhancing their knowledge and confidence.

Technological Innovations

Technological advancements have played a crucial role in the evolution of online trading apps. From artificial intelligence to blockchain, these innovations are reshaping the trading landscape. AI and machine learning algorithms are increasingly being used to analyse market data and predict trends. These technologies can provide personalised investment advice, automate trading processes, and even manage entire portfolios based on user preferences and risk tolerance.

Blockchain and Cryptocurrencies

The integration of blockchain technology and cryptocurrencies into trading apps has opened up new avenues for investment. Users can now trade digital currencies alongside traditional securities, diversifying their portfolios and exploring new financial opportunities.

Enhanced Security

Security is a paramount concern for online trading, and modern apps have implemented robust measures to protect users’ data and assets. Features like two-factor authentication, biometric login, and encryption ensure that users can trade with confidence, knowing their information is secure.

Regulatory Compliance

Many online share market apps are also ensuring compliance with financial regulations to build trust with their users. By adhering to regulatory standards, these platforms provide a safe and reliable environment for trading, attracting more participants to the stock market.

Impact on Financial Inclusion

The revolution brought about by these apps has had a profound impact on financial inclusion. By lowering barriers and providing tools for education and participation, these platforms are enabling a more diverse group of people to invest in the stock market.

Empowering Underrepresented Groups

Historically, certain demographics, including women and minority groups, have been underrepresented in stock market participation. Online trading apps are changing this by providing accessible and affordable entry points, empowering these groups to invest and grow their wealth.

Encouraging Youth Participation

Young people, who are typically more tech-savvy, are increasingly drawn to online trading apps. These platforms offer an engaging and modern way to learn about finance and invest, helping to cultivate a new generation of informed and proactive investors.

Online trading apps, indeed, have revolutionised stock market participation by making it more accessible, affordable, and educational. As technology continues to advance, we can expect such apps to further transform the financial landscape, fostering greater inclusion and empowering more people to take control of their financial futures.