The bear call ladder is a sophisticated options trading strategy designed to capitalise on a bearish market outlook. This strategy involves the strategic combination of call options to create a net credit spread. Traders implement this strategy when they anticipate a moderate decline in the underlying asset’s price. As an advanced options strategy, it requires a comprehensive understanding of options and involves multiple strike prices and expiration dates. Read on to learn more about how traders employ this approach to navigate bearish market conditions.

Table of Contents

Defining Bear Call Ladder

Defining Options

In options trading, an option contract provides its holder with the right, but not the obligation, to buy or sell underlying securities upon the expiration date. These financial instruments are readily available through brokers on their trading platforms, commonly situated in the futures and options section. Options serve as essential tools for investors, enabling risk hedging and portfolio expansion by leveraging the opportunities presented in margin trading.

Defining Ladders

A ladder refers to an option contract, either a call or put, which allows profit from a single or more strike price before the expiration of the contract. The changes in the asset value and the gap between the old and new strike prices allow more flexibility in the payoff. As the trigger strikes, it informs traders about the price change and reduces risk by locking a profit.

Defining Bear Call Ladder

The bear call ladder strategy is effective during a bullish trend. Though it may seem confusing at first, a thorough read of the article will provide a clear understanding. In short, the strategy involves purchasing a new call option (short call ladder) while financing it by selling another call option that is already in-the-money. However, a crucial condition for executing this ladder is ensuring that both call options share identical expiry dates, the same underlying asset, and matching volume.

Understanding Bear Call Ladder Strategy

- Mastering the application of the short call ladder strategy requires practice and patience to comprehend market movements.

- The initial step involves participating in a market exhibiting stronger movements to enhance the strategy’s effectiveness.

- Contrary to its name, the bear call ladder strategy is not inherently bearish; it offers an improvement over the call ratio back spread.

- Within the bear call ladder, the purchase of a call option is funded by selling the contract as an in-the-money call option.

- Typically set up for a net credit, the bear call ladder strategy ensures a cash flow that surpasses that of the call ratio back spread.

- It’s crucial to note that both strategies showcase similar payoff structures with slight variations in the risk structure.

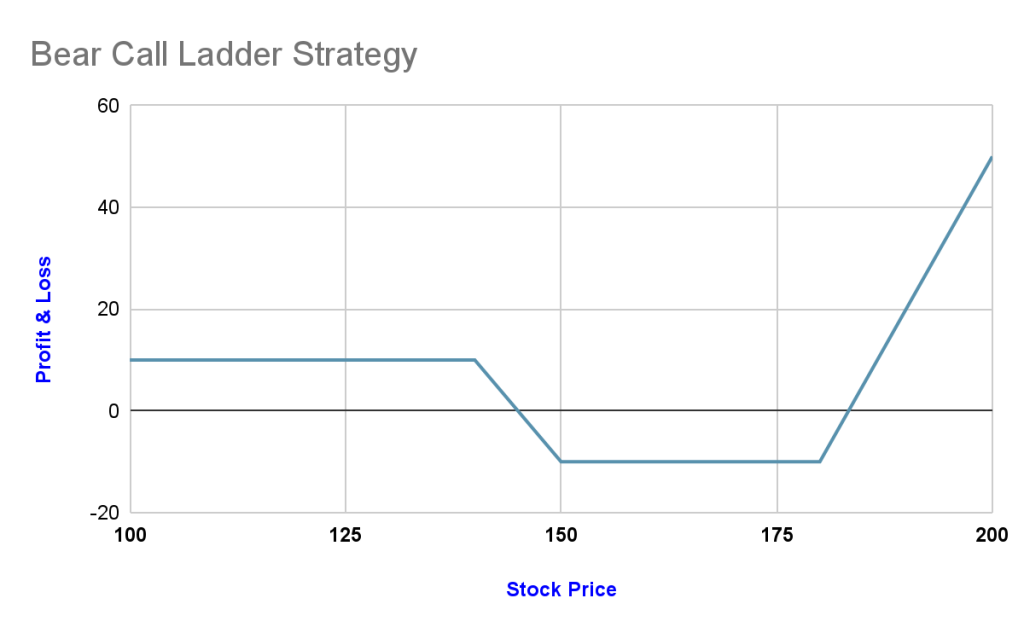

Example of Bear Call Ladder Strategies

Let the Nifty spot be 17750, and you can expect that the trade can move to 18150 by the end of the expiry date. Consider the following contract, which can be initiated in the bear call ladder strategies.

- You need to sell one ITM call option at 17600 CE and release a premium option of, say ₹250

- After that, buy one ATM call option at a premium price of ₹119

- Now, in the end, buy one OTM call option at a paid premium amount of ₹70

- Calculate the net realised profit from the deal which will be ₹250-₹119 = ₹61

The example above illustrates the bear call ladder trade concept. Implementing such strategies involves a distinct approach, necessitating careful analysis of the asset before execution. It requires navigating the market to identify the optimal securities for this specific option strategy. The successful application relies on thorough asset analysis and strategic selection within the market.

Advantages of Bear Call Ladder Strategy

- The bear call ladder strategy offers a means to rectify losses incurred in the bear call spread strategy.

- Engaging in the upside movement becomes possible while constraining the downside risk of a trade.

- The bear short call ladder proves advantageous when anticipating an unexpected movement in the underlying financial instrument.

- This strategy allows for limited risk exposure with the potential for unlimited rewards.

Disadvantages of Bear Call Ladder Strategy

- A significant drawback of the bear call ladder strategy is the impact of time decay, particularly when the stock price fluctuates between lower and middle strikes before surging higher, making it challenging to discern the trend direction.

- To identify the trend in such situations, it becomes crucial to have a keen awareness of the support and resistance levels specific to the involved securities.

Greek Line

The use of Greek terms in options trading denotes varying levels of risk. These values, represented by Greek alphabets, play a crucial role in hedging risk in both the bear call ladder and the call ratio back spread techniques. In this context, the following lines convey specific statements:

- A blue line signifies an increase in volatility in the 30 days leading up to the expiry.

- A green line represents the volatility range over 15 years.

- The last red line illustrates volatility when the expiry date is imminent.

Conclusion

The bear call ladder is an options trading strategy designed for a bullish market outlook, despite its name. It involves selling in-the-money call options, and financing the purchase of out-of-the-money call options. This strategy aims to capitalise on potential market declines while offering a net credit setup for traders. Implementing this strategy requires a comprehensive understanding of options and careful consideration of strike prices and expiry dates to optimise potential profits and manage risks effectively.